Paytm is the most used digital wallet in India right now and is now quite ingrained into the ecosystem of digital payments. After demonetization, it has got a very big boost and now even our local Kirana stores to office canteens accept payments through Paytm. However, recent RBI guidelines plan to bring a spanner into this seamless way of paying one another. All online wallets are now mandated to get the KYC of their users failing which the users won't be able to do wallet to wallet transactions nor will they be able to upload more than Rs.10,000 in their wallets within a specific month. Paytm has welcomed this guideline unlike many other smaller wallet operators and for the same has contract employed a large workforce to get the KYC done.

After clicking the Proceed button you will be asked a few more personal details like Nominee name, your occupation, Marital status and your address. Enter these details.

You should expect a call from Paytm representative for scheduling an appointment where your Aadhar based biometric verification will be done.

What do I need for Paytm KYC

- Aadhar card number

- PAN card

Steps to get Paytm KYC done

- Open your Paytm Android or iOS app.

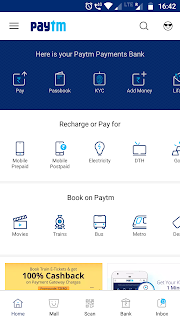

- In the top menu, you should be able to see a KYC button just between the Passbook and Add Money buttons.

- Once you click on the KYC button you should now be prompted for your Aadhar card number. Enter your Aadhar card number and check the Terms and Conditions before selecting the checkbox.

That's all!

As soon as your biometric verification is done your Paytm account will be KYC compliant and you will have your own Paytm bank account along with your wallet limit renewed to Rs.1,00,000. You also won't have any issues in a wallet to wallet transaction. For any questions or queries please use the comment section below.

Comments

Post a Comment

Have something to add or have a question for us? Or just want to comment of the quality of the article? Feel free to leave a comment!